Stock Fundamentals: What Is It And How Does It Work

Investing in stocks can be a rewarding experience, but it can also be confusing for beginners. One of the essential aspects of investing in stocks is understanding stock fundamentals. In this article, we will discuss the basics of stock fundamentals and how they can be used by investors to make informed investment decisions.

What Is Stock Fundamentals?

Stock fundamentals is the financial and economic data of a company that can be used to analyze its performance and potential growth. These data points are derived from the company’s financial statements, which are quarterly or annual reports that provide a comprehensive overview of the company’s financial health.

Why are stock fundamentals important?

Stock fundamentals are important because they help investors make informed decisions about which companies to invest in. By analyzing a company’s financial statements and ratios, investors can determine the company’s overall financial health, growth potential, and valuation. This information can be used to evaluate the stock’s potential for long-term growth and profitability.

Types of stock fundamentals

There are two main types of stock fundamentals: financial statements and ratios.

1. Financial statements

Financial statements are documents that provide a comprehensive overview of a company’s financial health. There are three types of financial statements:

a. Balance sheet

A balance sheet provides a snapshot of a company’s financial position at a specific point in time. It includes information about the company’s assets, liabilities, and equity.

b. Income statement

An income statement provides a summary of a company’s revenues, expenses, and net income over a specific period. It helps investors evaluate a company’s profitability and growth potential.

c. Cash flow statement

A cash flow statement provides information about a company’s cash inflows and outflows over a specific period. It helps investors understand a company’s liquidity and ability to generate cash. So to have a good finance, you have to know how to manage your cash flow properly.

2. Ratios

Ratios are mathematical calculations that provide insights into a company’s financial health and growth potential. There are several key ratios that investors use to evaluate stock fundamentals.

Examples of stocks with strong fundamentals

Some examples of companies with strong stock fundamentals include Apple, Amazon, and Microsoft. These companies have a history of consistent revenue growth, profitability, and strong balance sheets.

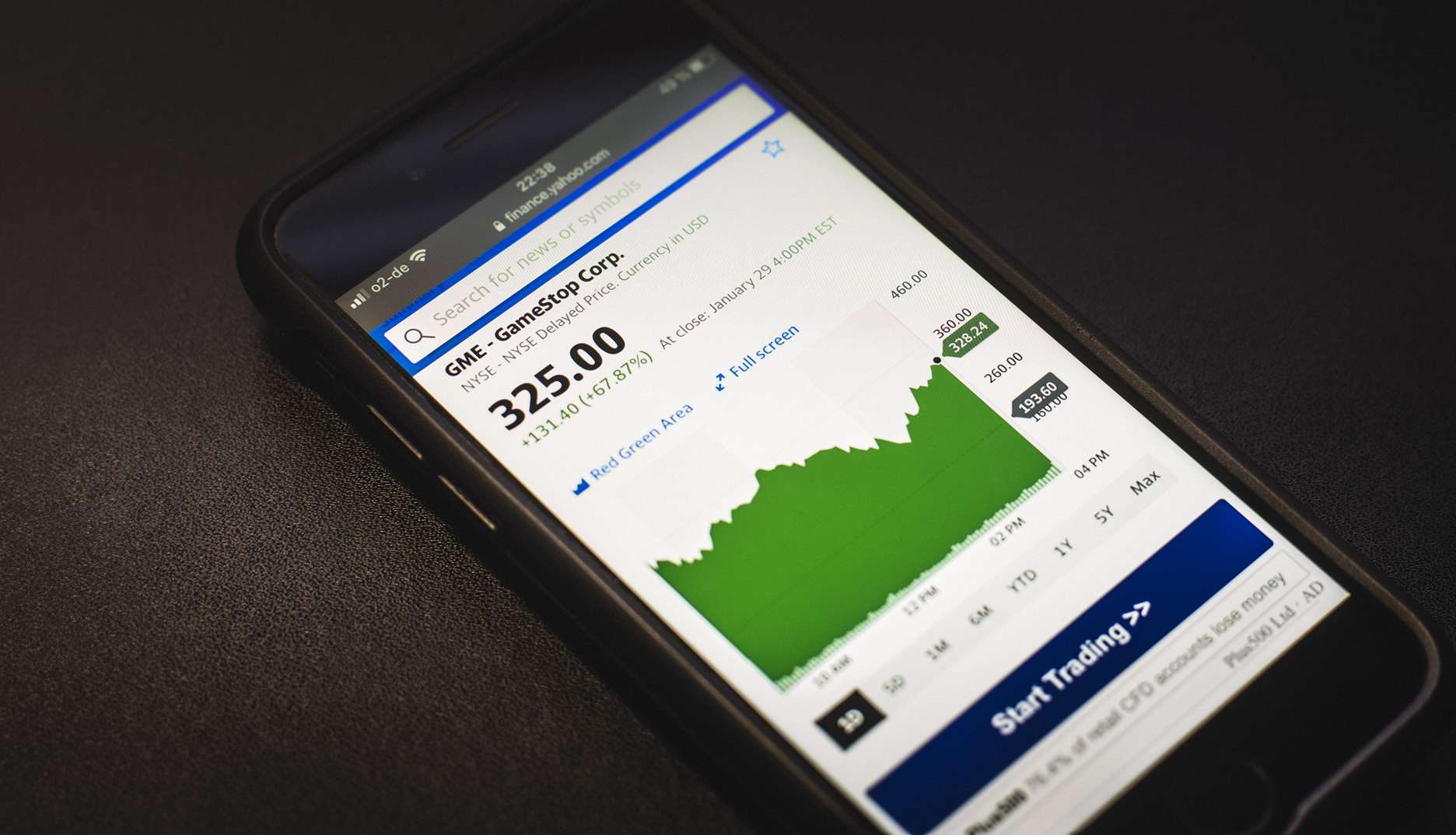

Examples of stocks with weak fundamentals

Some examples of companies with weak stock fundamentals include Sears, JCPenney, and GameStop. These companies have a history of declining revenue, profitability, and poor financial health.

Conclusion

Stock fundamentals are an essential tool for investors to evaluate a company’s financial health and growth potential. By understanding financial statements and key ratios, investors can make informed investment decisions that can lead to long-term growth and profitability. However, it’s important to remember that stock fundamentals are just one aspect of investing and should be considered alongside other factors. Make sure you have understand what is stock market too.