What Is Return On Investment (ROI), What Is It For, And How To Calculate It

ROI or Return on Investment is a rate that will show after you calculate certain factors before investing. These numbers however represent the probability of you gaining profit from your investment, hence the money will be returned based on your investment itself. Return on investment rate can be a useful way to determine which investment might prove beneficial, and which could yield more profits.

What Is Return On Investment Rates?

To put it simply, ROI is a ratio that shows us the profits you could gain from that investment, or loss if that is the case. Return on investment is a key component that every investor should know, especially on how to calculate them accurately, and how to evaluate them for your business portfolio.

In the business analysis world, Return on investment shows us the cash flow, and any other measurements of how the investment would pay out, for example, the IRR or internal rate of return, or the NPV (net present value. These are some key components of the return on investment.

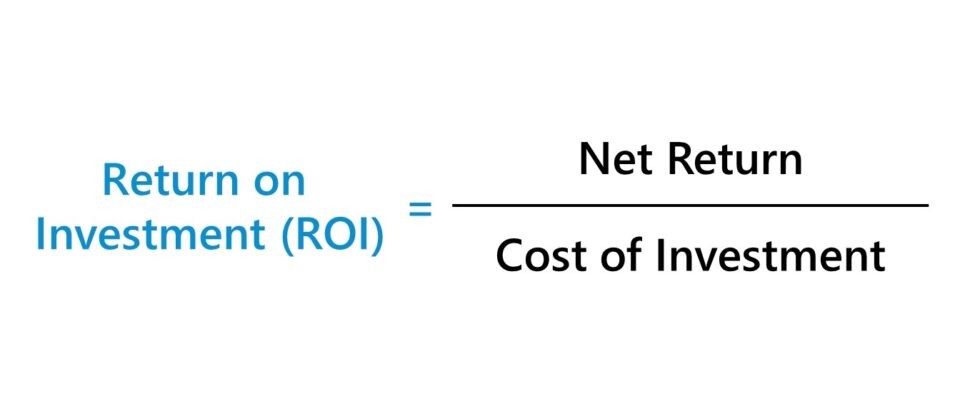

How To Calculate It?

There are two methods of calculating finance of the ROI ratio, as you can see here. The first method is by dividing the Net return on investment rate by the cost of investment, after that convert that amount into a percentage and there you go, you got the Return on investment ratio.

The second method is first subtracting the final value of the investment from the initial value of the investment. This way, you can see if the investment itself bears profit or margin loss, and how much it is. After that, turn it into a percentage by multiplying it by 100%.

How We Interpreted The Return On Investment Ratio?

There are a few things to keep in mind whenever you are reading the return on investment ratio. First of all, it is typically in the form of a percentage, since it is easier to understand, and then converting it into readable data. Next, the calculation itself could be either negative or positive, positive means that the investment bears profit, while negative means there is margin loss on the investment.

In the trading chart, we can see that the positive number will turn black, while the negative number will turn red. See also the candle chart and how you can read it to become a better trader and stock investor.

Examples Of How To Calculate Return On Investment

Supposedly an investor is buying a stock: 1.000 shares to the Electronica company, and the price is $10 per share. This means the initial investment is $10 x 1.000 = $10.000. Over years, the investor held it, and then sold it over a year later for $12.50 per share, since the price is indeed increasing per stock.

The investor then earned a dividend value of $500 over his investing periods. After calculations, the ROI number then turned into a positive 28.75%. You can also calculate the return on investment ratios using an automatic calculator.