Compound Interest Calculation and Its Functions

Compound interest is a term that may be foreign to some people. The term “compound” means that you can get many times the interest on your savings account, depending on how long you have been saving. Many people benefit from the compound interest formula.

Compound interest is interest that is calculated from the principal of the savings and accumulated interest over a certain period. The term compound means there is “interest on interest”. This is why you can get interested that is many times the interest set by the current bank.

Interest accumulated over a certain period and added to the principal amount will result in a greater value. Are you interested in the calculations?

How It Works and Its Functions

Compound interest earned from the principal and interest accumulated over a certain period. Usually, this interest is calculated periodically, namely 12 times a year, 4 times a year, 6 times a year, or annual interest.

This is what makes interest income affect the growth of money. For more details, here is the compound interest calculation by financial organizations or banks:

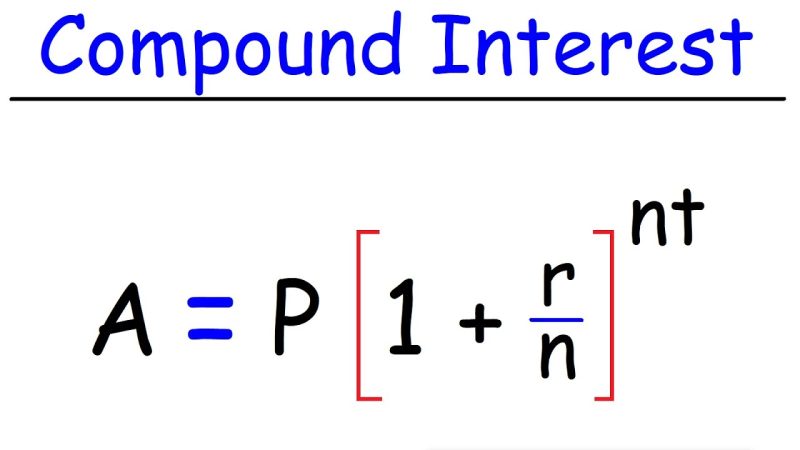

The Formula

To calculate how much interest you will get, there is a formula that needs to understood, namely:

P x (1 + r) n = A

P = Principal or opening balance

R = Bank interest rate per period

N = number of periods

A = Ending Balance

For example, to calculate compound interest for two years on a $1,000 balance at a 5% annual rate, this would be calculated as:

The annual interest rate of 5% multiplied by 12 months is 0.0042. Furthermore, to calculate the period, then 2 years multiplied by 12 months per year, which is 24.

$1,000 x (1+0.0042) 24 = A

$1,000 x 1.106 = A

$1,659 = A

So the final balance you get is $1,659 which has been added up with compound interest over 2 years.

How Compound Interest Works

The formula for calculating compound interest is quite simple, but this also looks at the interest rate set by the bank for a certain period. When you want to get the interest, you can get it from the initial balance of your savings.

To get compound interest, banks usually determine the calculation period. You can get in a certain period even up to 10 years. This is what makes many people want to gain that profit.

Compound interest is a form of long-term investment, especially when you have never used bank savings. You can get many benefits from this type of interest, it can even provide wealth for you.

Moreover, interest rates continue to rise, making many people benefit from compound interest today. This called magic and make your portfolio bigger.

The positive side of the compound interest formula is that it is profitable for investors and increases your wealth. Because the more years, the more value you get.

Compound interest income also taxed. So even if you get a lot of profit, you still have to pay wealth income tax from compound interest.